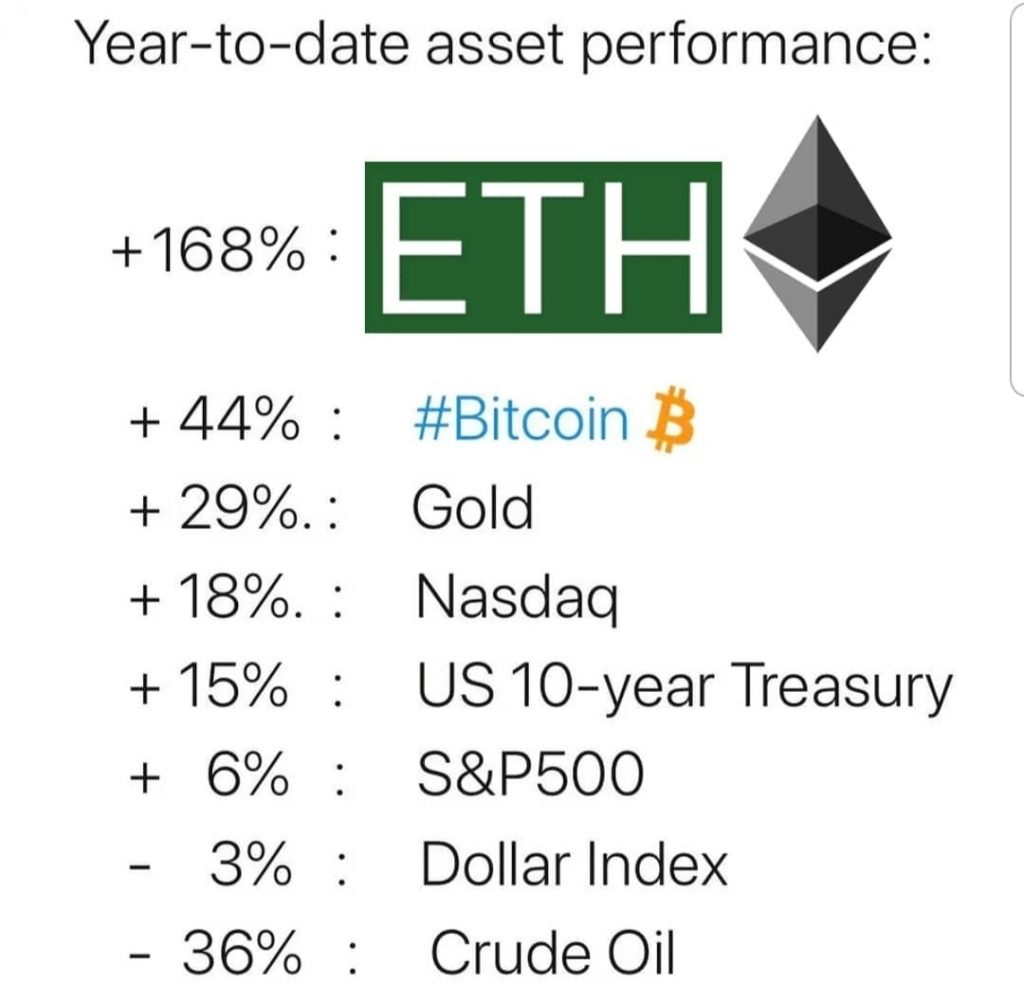

About 9-months into 2020, Bitcoin (BTC) has produced an ROI of 48.7% since the start of the year, outperforming other assets and investments like gold, the S&P 500 index, NASDAQ Composite Index, the US Dollar Index, and the Crude Oil WTI.

Bitcoin (BTC) – the number one cryptocurrency started the year at a price of $7,215 and is currently trading at $10,903 at time of this publication; down from this year’s all-time high of $12,359.06 hit in August 2020.

This price rise has been synonymous with Bitcoin’s known attribute to always double on its yearly start price; as replicated again this year.

Popularly known as the “Digital Gold”, Bitcoin has shown an interesting correlation with the precious metal Gold (AU) which has also had a good year surging past its 8-year price to set a new all-time high; even though its gains have still been dwarfed by Bitcoin.

A look at the YTD (year-to-date) performance of various investments and asset class show a huge percentage gap in returns from Bitcoin (BTC) over others. Notably, Gold was trading around $1,540/oz at the beginning of 2020 and is currently going for $1,861.68/oz – which is a 20.8% increase this year.

The NASDAQ Composite Index is up 21.63%. The S&P 500 is up only 2.09%.

In contrast, the US Dollar Index is down 1.88% this year, and crude oil is also down a whopping 34.59%.

Overall, cryptocurrency assets and coins have returned very high profits for traders and investors this year.

Despite an early economic scare which saw Bitcoin, altcoins, and stocks dip in the early months of COVID-19 (March 2020), the markets have rallied back with bullish momentum.

A key contributor to the big crypto profits this year was the launch of DeFi tokens and the hype around them. DeFi coins like Chainlink (LINK), and Yearn.Finance token (YFI) which hit a $38,000 price in weeks, set the turn for a mega market.

In all, while the crypto market remains volatile and price corrections are a fundamental characteristic, the number of profitable days for BTC and most good altcoins overshadow their price dips.

Is Bitcoin/cryptocurrency your choice investment asset? Share with us in the comments below.