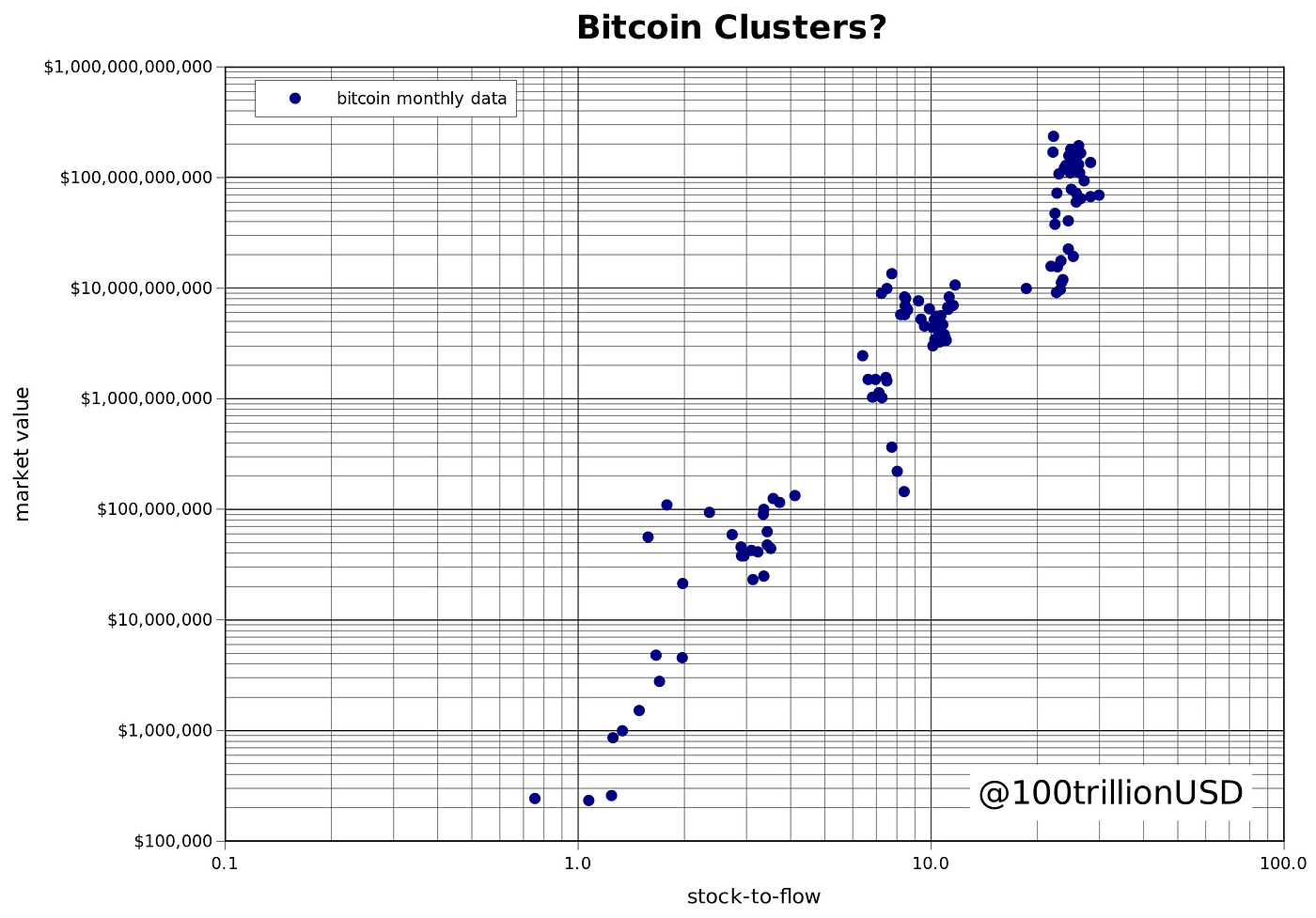

According to a new stock-to-flow forecast, Bitcoin prices could reach $288,000 in 2024. The model is based in-part on “clusters” for Bitcoin as it moves between different use cases.

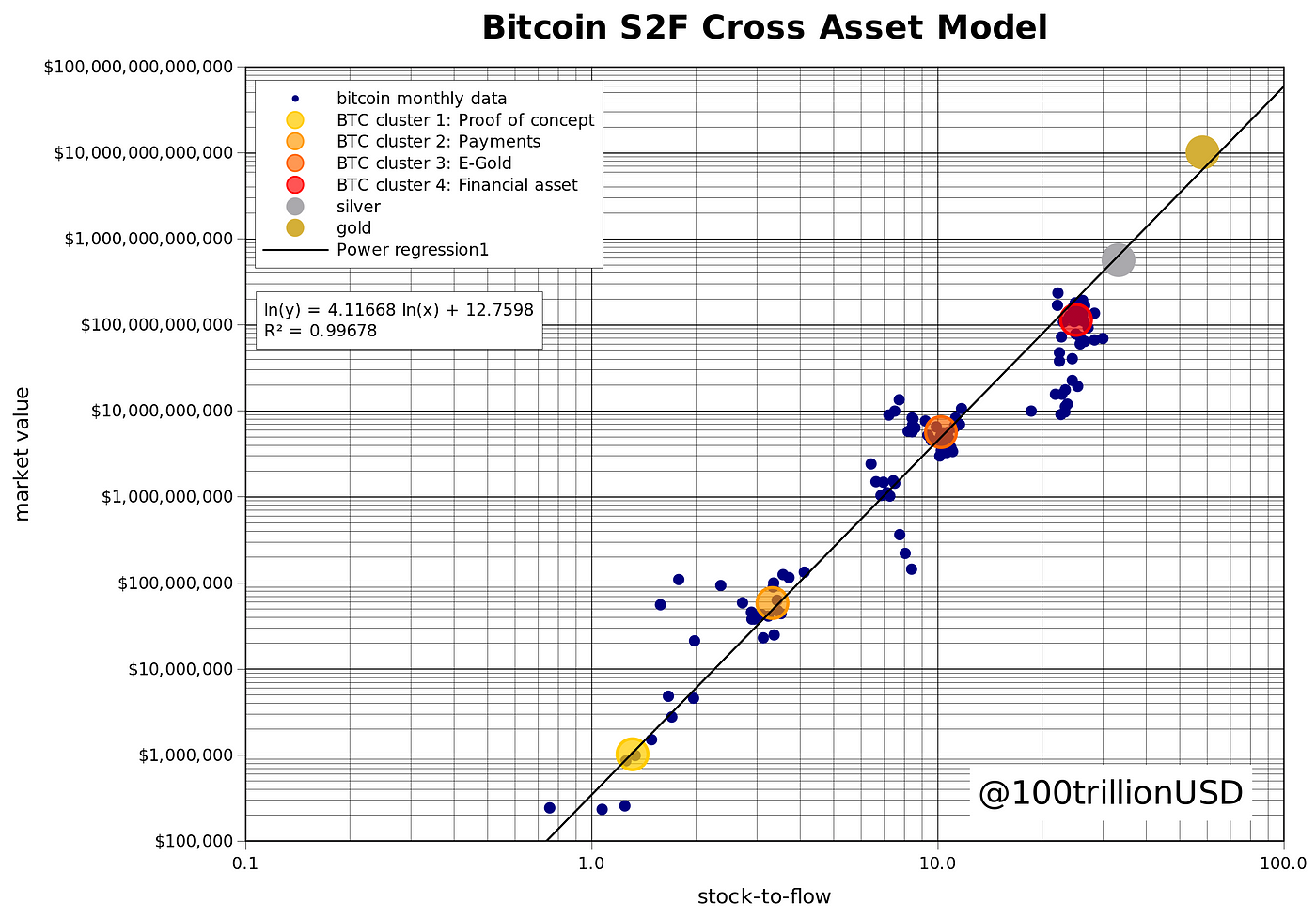

According to cryptocurrency expert, PlanB, Bitcoin is considered as proof of concept for payments, e-gold, and as a financial asset.

The different clusters represent different price points for the cryptocurrency. The market value of Bitcoin differs for each cluster

An example is used to explain the different price points. Water has different value points as it changes forms. This is the same with Bitcoin. PlanB compares the price points to the different states of water.

“Water exists in four different phases (states): solid, liquid, gas, ionized. It is all water, but water has totally different properties in each phase.”

Not only can the model be used to evaluate Bitcoin, it can also be used to evaluate the price of other assets such as silver and gold.

PlanB says,

“I call this new model the BTC S2F cross asset (S2FX) model. S2FX model enables valuation of different assets like silver, gold and BTC with one formula.”

The dollar transitioned from gold coin to paper backed bolg, to paper backed by nothing. In a similar way, BTC narratives have changed over time. Bitcoin transitioned from “Proof of concept” (after Bitcoin white paper) to payments where USD parity was achieved, to E-Gold where 1 BTC was equal to one ounce of gold. After the fourth transition, a milestone was achieved with $1 billion transactions per day being achieved.

Chamath Palihapitiya (the CEO of Social Capital and the chairman of Virgin Galactic) has pointed to a $1,000,000 Bitcoin price in the future. If the model presented by PlanB is correct, such a price prediction may no longer seem as far fetched as it sounds.