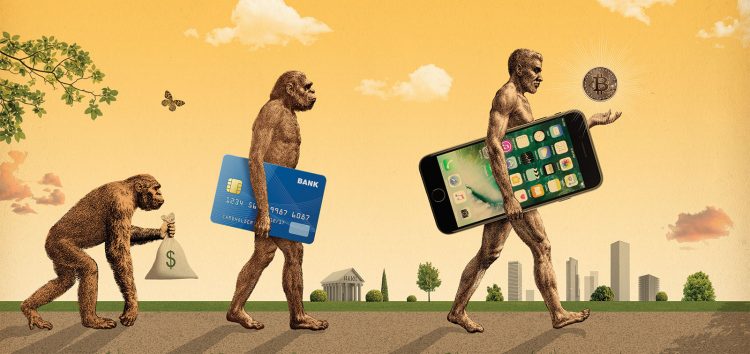

Germany’s Deutsche bank – the world’s 17th largest bank by total assets has made an interesting prediction following a recent research; hinting that digital currencies will replace cash by the next decade 2030.

According to the research titled “Imagine 2030” report, Jim Reid and Marion Laboure – both Deutsche Bank strategists highlighted the challenges of the current fiat system including cards, and a possible financial succession by cryptocurrencies.

Reid argues that the increasing demand for dematerialized means of payment and monetary privacy could drive more individuals to digital currencies.

The report opines that for crypto to gain widespread acceptance, digital currency must scale three (3) hurdles. They include: A need to maintain perceived legitimacy by government and financial regulators, price stability for digital assets and a global reach in its use for payments.

To achieve the above, Reid suggests a partnership between cryptocurrencies, financial mobile apps and card providers as a catalyst for this development.

On the counter side, the report highlighted a few risks that could arise with mainstream adoption, such as: Dependence on electricity, Cyberattacks, and a Digital war between cryptocurrency, public and private financial institutions.

In all, the Deutsche Bank report points out a possible Central Bank Digital Currency (CBDC) era by 2030, considering the move by Central Banks globally who have openly attested to studying the feasibility of issuing their own digital assets.

Do you see a Digital Currency based financial system by 2030?