Bitcoin price rallied to $11,394 in the late hours of Monday 10:00 pm Nigerian time, effectively smashing past the 10,500 psychological level and resistance as it set a clear path for a new 2020 high.

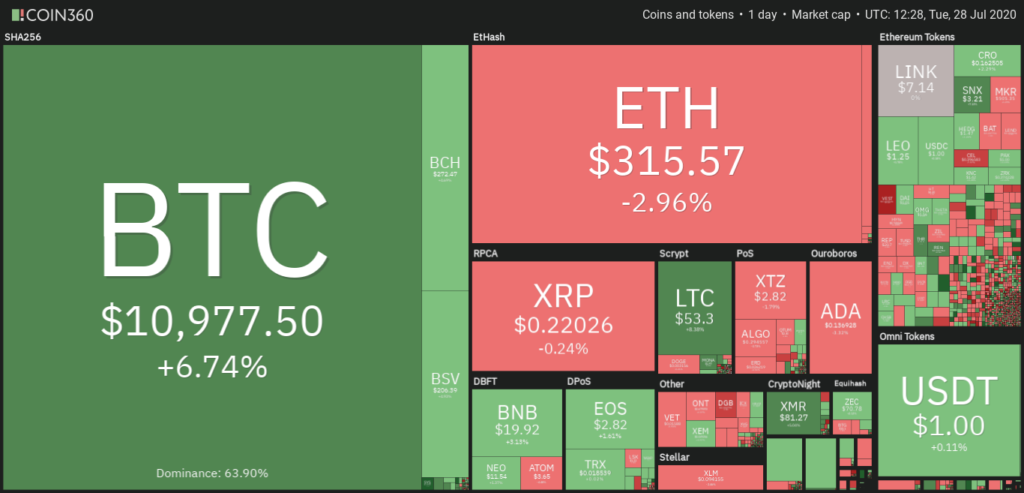

At the time of publication, Bitcoin (BTC/USD) has pulled back to around the 10,970 price level after a third shot at $11,000.

It will be recalled that the price of Bitcoin stayed stuck around the $9,000 to $9,500 range since May, with technical analysts predicting that its sideways movement up or down will be massive.

A look at the BTC chart shows a sustained increase in purchasing volume which has continued to rise on the 1-hour time frame; thus indicating that the bulls are not yet done and BTC could see another leg up above $11,300.

There has also been a significant rise in exchange inflow since BTC surged past $10,000, coupled with increase in transaction activity on the blockchain.

Bitcoin dominance against the total cryptocurrency market currently stands at $62.5%, with the overall cryptocurrency market cap at $323 billion.

With investors flocking to get a hold of assets as the global economy wanes and governments excessive money printing continues, Bitcoin and natural commodities – Gold and Silver seem to have set the tone for the year as all three (3) assets reached new milestones heading into this week.

Notably, Gold breached its all-time high price set since August 2011.

Bitcoin on its part has come to be known as the ‘Digital Gold’ and a store of value with incredible returns, however for most investors its volatility maybe its most challenging characteristic.

Some analysts have pitched Bitcoin and Gold side-by-side showing an interesting correlation in their chart pattern. Most investors maintain that of all assets, BTC remains the “fastest horse”.

Following BTC increase to $11, 000 levels, traders, technical analysts, and investors have made predictions for the price in the short, mid, and long term.

Speaking on the sharp bullish trend, crypto analyst Max Keiser projects a new high for the coin at $28,000. He posted a series of tweets where he laughed off claims by Bitcoin antagonist Peter Schiff after his calls on a possible Bitcoin dip.

Barry Silbert – CEO of Grayscale and crypto firm DCG says the next resistance for Bitcoin is at $13,000.

For PlanB creator of the Stock-to-Flow (S2F) Bitcoin price model, BTC’s rise to current levels has set the tone for new strong support. He explained:

In the short term, traders are eyeing a strong weekly close for BTC, as many say the number one cryptocurrency needs to be above the 10,500 -10,900 region to confirm a proper rally.

After weeks of massive gains for altcoins partly fueled by the DeFi hype, the ALT/BTC pairs saw red as BTC continued the run-up .

This is a characteristic occurrence when BTC pumps as the alternative cryptocurrencies correct in response to an increasing Bitcoin dominance.

Analysts expect alts to pick up once BTC consolidates around a price range; however notable coins like BNB, ERD, BQX, ETH, and KNC all show signs of moving with BTC.

What are your thoughts on the cryptocurrency market at this point? Is the bull season activated?