Bitcoin (BTC) price chart just formed a technical pattern known as golden cross; similar to the formation before BTC reached its all-time high of $20,000 in 2017.

A “golden cross” occurs when BTC/USD sees its 50-day moving average rise to cross over its 200-day moving average. This current pattern has many traders indicating a possible rally above the $10,000 region.

Just weeks after the third halving in BTC history, the cryptocurrency’s price has been trapped between the 9200 – 9700 range after its recovery from a post-halving correction.

Haven struggled to push above the $9900 price point – which remains a critical point for an uptrend to $10,000, Bitcoin has been caught between two paths – break or dip.

The market sentiment at this point is majorly bullish, with some traders highlighting a rally to $10,200, and further closing above that price will push BTC upward to $10,500. Others believe that a dip below the $8900-$8500 support zone will mean a prolonged sideways price action for the rest of the year.

Crypto trader Nunya Bizniz noted:

For the first time during the 2015 lows, there was a golden cross, death cross, golden cross sequence that occurred all within the span of about 100 days. Price then rallied 6,400%. For the 2nd time at 2020 lows, this sequence has again occurred within about 100 days.

Price will..?

With all the hype around the golden cross formation, it is worthy of note that this is the seventh time both moving averages (50 MA & 200 MA) have crossed in Bitcoin’s history.

From technical analysis, the above occurrence is usually interpreted as a bullish signal, and an increase in buying pressure should see BTC break upwards.

However, not all golden crosses have triggered a price rally. A notable example was the golden cross of February 2019 which was followed by a strong price drop to $3,750 less than a month after – March 13.

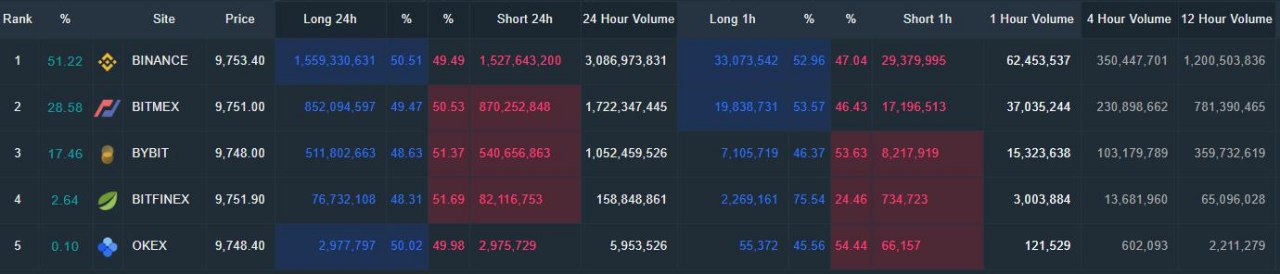

Most Bitcoiners look to pitch more on the bull scenario; a look at the Bitcoin Longs vs Short statistics on exchanges over the past one hour shows that traders have opened more long positions probably in anticipation of a break out.

For the short term, many traders insist a breakout from the $9,900-$10,000 resistance zone with an equal high volume would see BTC push above $10,071 and then $10,200.

A move towards the 2020 high of $10,500 would further keep the digital asset in a long term position for the confirmation of a new bullish cycle.

In a bearish scenario, where BTC continues to get rejected at the $9,900-$10,000 resistance; these rejections could see price drop to levels $9,600, $8,900-$8,550, and worst case scenario a dip to the $7,438-$7,200 region – if the support levels above do not hold.

NOTE: This publication does not represent investment advice. Opinions expressed here are solely the of the author, not a representation of the views of Bitcoin.NG.

Key insights from Horus Hughes