We take a look at Satoshi Nakamoto’s Bitcoin White Paper, analyzing key factors that prompted his invention.

These factors could be summarized under the following headings:

1. The need for Peer to Peer transactions

2. A currency with Cheap Fees for transactions.

3. Privacy

4. A medium for Speedy transactions.

5. Security through use of an immutable ledger called blockchain.

A key concept of Satoshi’s Bitcoin creation is the need to eliminate third parties in the chain of financial transactions.

The original Bitcoin model is expected to function just like today’s email – from sender to receiver directly. No third party processing or middle man institutions like today’s banks.

Satoshi proposed the system to be person-to-person, that is both parties involved in the transaction settling the transactions in real time.

The abstract of the Bitcon white paper reads:

A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution. Digital signatures provide part of the solution, but the main benefits are lost if a trusted third party is still required to prevent double-spending. We propose a solution to the double-spending problem using a peer-to-peer network. The network timestamps transactions by hashing them into an ongoing chain of hash-based proof-of-work, forming a record that cannot be changed without redoing the proof-of-work.

This concept was hinged on the need to offer people a cheaper payment system, and Bitcoin has sure lived up to this concept.

While traditional fiat payment/financial systems charge high fees for local and international transfers, Bitcoin remains one of the cheapest modes of payment and remittance globally.

Example: To send $1000 to a friend from Canada to Nigeria using regular payment / fiat (cash) systems would cost around $20-50 in fees. In contrast to Bitcoin which is around $0.5 cents to $2.

Even with the surge in Bitcoin network fees due to high transaction activity during the last halving, the fees charged by miners on the network are still considerably lower than those of cash payment systems.

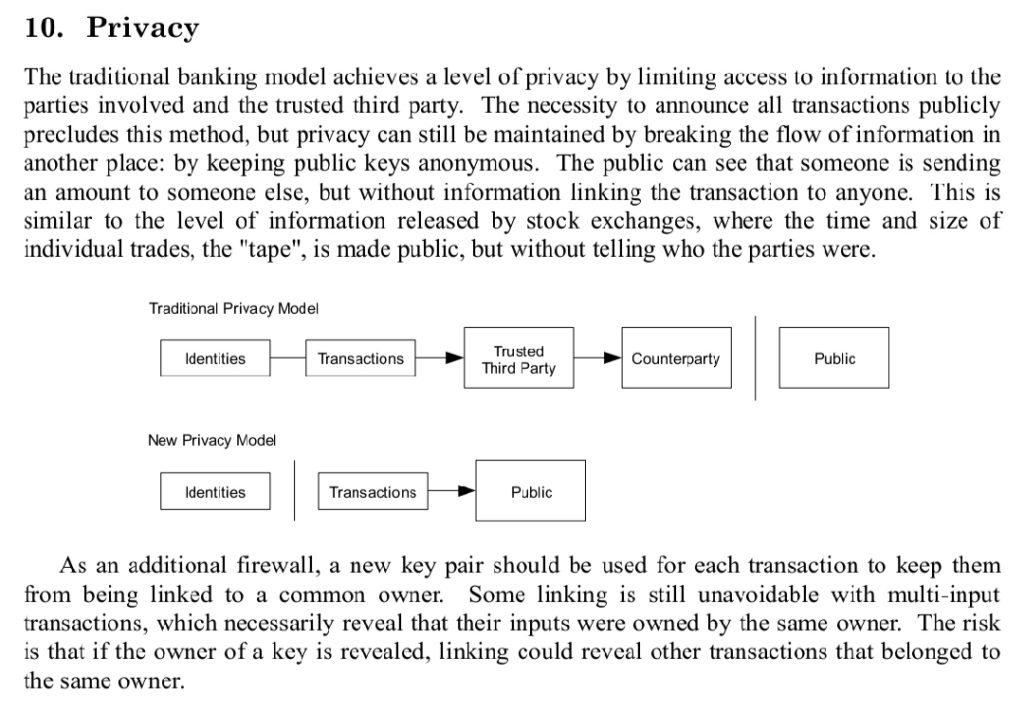

Setting up a Bitcoin wallet is a pretty simple task. Takes a few minutes and interestingly, you’re your own bank.

No rigid Know your customer (KYC) processes, your wallet holdings/funds are known to you alone.

Bitcoin grants unique immunity from censorship or financial controlling policies. You stay private and in charge of your finances.

See how to open a bitcoin wallet here.

Just as with the email analogy, Bitcoin transactions take seconds, in very rare cases minutes to confirm on the blockchain.

This is in contrast to regular cash payments which are subject to processing delays – between 3-7 days for some international payments. There are also network delays as experienced with banks and other technical issues.

Bitcoin on its part works in an instant, you send and receive anywhere in the world at any time. In cases of huge network traffic or congestion, the introduction of Lightning Network technology offers the ability to send and process Bitcoin transactions like the speed of light.

So it’s less hassles, no issues of network delays or reversals.

Bitcoin is the email of money. Bitcoin is the future of money.

The bitcoin network remains one of the strongest financial networks. Built on the blockchain, Bitcoin transactions are secure and publicly accessible.

Blockchain technology offers a unique immutable (cannot be modified) ledger for bitcoin transactions. This mechanism ensures that Bitcoin transactions cannot be rolled back or edited, and it grows stronger by the day. As more transactions occur, more blocks are created and more nodes are distributed making the network unhackable.

Wallets like bank accounts can be tampered with if not well secured, but the bitcoin network itself is untouchable. See wallet security measures here.

A New Financial System: Bitcoin offers a liberation from the redundant financial system, asides its use for payments, Bitcoin serves as a store of value and an appreciating asset.

Its unique feature of only 21 million bitcoins ever also make it suited as a non-inflationary asset, one which equates the dollar and has well rewarded holders with profits; hence the name “Digital Gold.”

Bitcoin is a unique transfer of wealth.

Health Benefit: Bitcoin has paved way for discussions into digital currencies on a global scale. Governments now seek digital currency as a medium to overcome the challenges of the current fiat system.

However, with the COVID-19 pandemic, national digital currencies are soon to be a necessity than an option. The possibility of virus transmission via cash notes, cards and other payment options, indicate bitcoin and digital currencies offer a more health-driven payment model.

What are your thoughts on these concepts of Bitcoin’s creation? What did we miss?

NOTE: Opinions expressed here are solely of the author, NOT a representation of the general opinions of the Bitcoin.NG team. This is not financial advice.