The United Kingdom Pension and Welfare Agency has described blockchain and distributed ledger technology as potential tech for the payments industry.

According to an official blog post, the Department of Work and Pensions (DWP) through Deputy Director Richard Laycock says the DWP is seeking ways to revamp its payment system, for an efficient, fast, scalable and available 24/7 system; one which blockchain and distributed ledger technology offers.

We are starting to see the first full production implementations…The benefits include reducing time, cost and failure associated with making transactions whilst data is stored on a secure immutable ledger…I am keen for us to consider how we can harness the payment innovations coming out of these trends and how we can influence the new payment architecture to help shape future of payments across government.

– Richard Laycock (Department of Work and Pensions, United Kingdom)

The Department of Works and Pensions serves as the UK’s agency for management of welfare and pension policies, and is set to implement changes to its payment scheme prior to an official roll out of the new system slated for 2021.

Pension schemes all over the world are confronted with a host of challenges, and in the case of Nigeria it is of major concern. Major problems encountered include embezzlement of pension funds, delayed payments of retirement benefits, cases of ghost pensioners, lack of accurate pensioner’s data and many more.

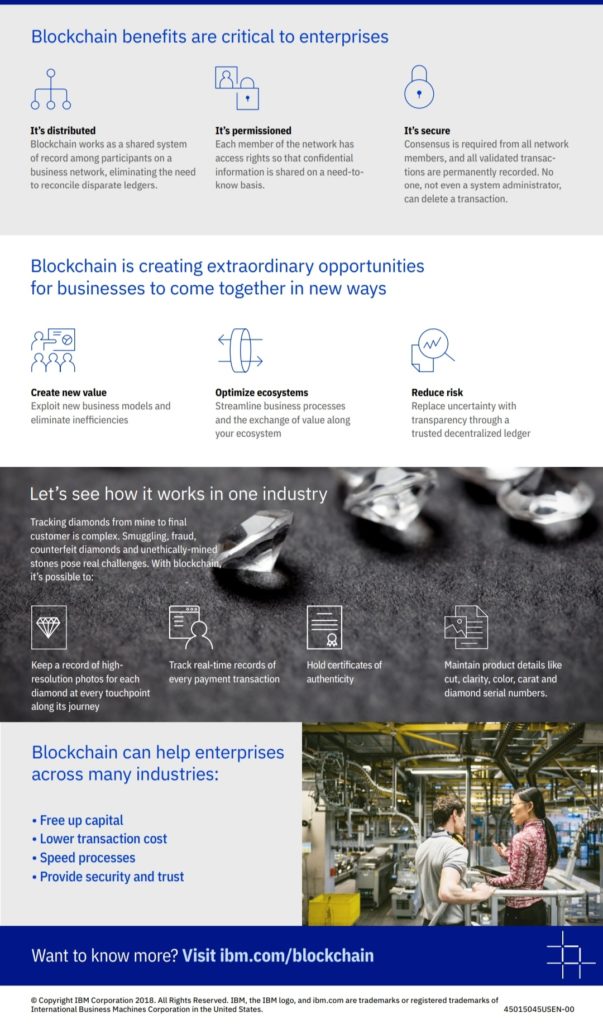

At this time, these challenges have hindered a smooth process of pension fund management and disbursement. However, there is a possible solution to the current system one provided by use of blockchain technology.

Blockchain-based pension systems seek to reorganise the pension infrastructure to focus on easy and efficient financial payments for the welfare of the aging population. Blockchain offers low-cost, fraud –free (immutable ledger) transactions; through organized data registration and traceability of funds and pension activity.

There is also no single entity (no centralization) in control of the pension ledger hence cases of fraudulent modifications are curbed.

Asides the above benefits, a blockchain pension system includes support for investments in digital assets, a decentralized and flexible pension products market place, and options for tokenization. All these in turn will increase user participation in the pension industry.

See sample blockchain pension projects: www.akropolis.io

What are your thoughts on this? Will Blockchain technology solve Nigeria’s pension problem? Share in the comments.

.