Hi, I know you’re here to find out how much you’d have made if you bought $1 of Bitcoin BTC every day from 2015 till date. Well, I’ve got good news for you…You’d have made a lot of profit and be probably rich; but sadly maybe you just didn’t buy at all.

Let’s find out how much you missed or gained.

According to James Todaro – a managing partner at Blocktown Capital, he shared an interesting video on Twitter, showing what would have happened if anyone invested $1 daily in bitcoin over the last five (5) years.

As depicted in the video, you’d have about $22,263 worth of BTC today, also taking into consideration pumps and dips in Bitcoin price.

From Todaro’s video, it is clear that for approximately $1 (a bottle of coke and agege bread) a day, you could have accumulated over $20,000 BTC.

Also, this further emphasizes the fact that you do not essentially need 1 complete Bitcoin to get started. In Nigeria, $1 is approximately 350 Naira daily.

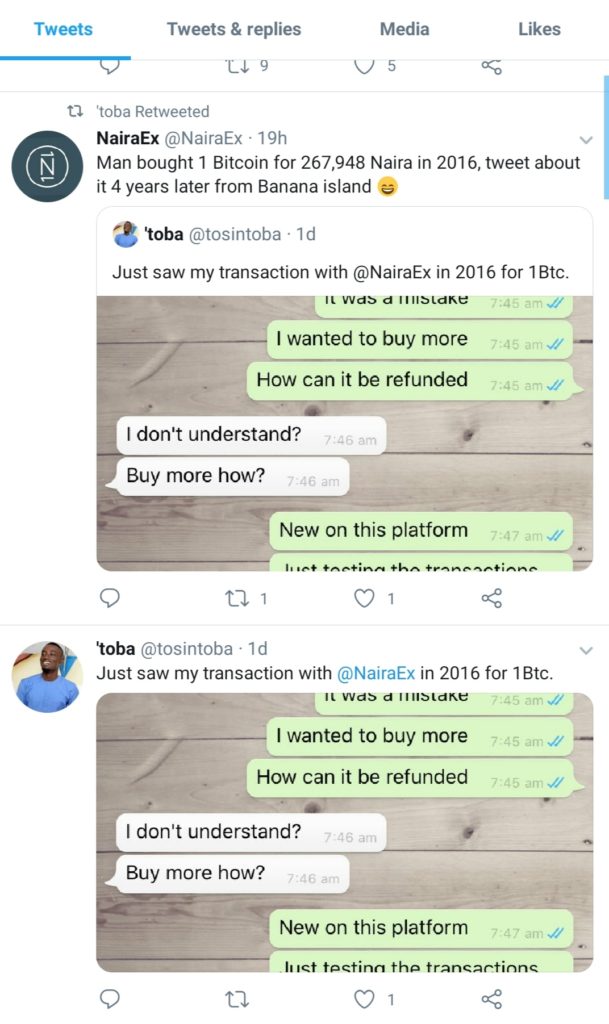

Notably, a customer of Nigeria’s premier Bitcoin exchange – NairaEx shared a conversation on Twitter showing he bought one complete BTC for just 267,948 Naira in 2016; against today’s current price of 3,530,520 million Naira at $9,807 per coin.

NairaEx now allows you buy as low as $1 Bitcoin instantly.

The term Dollar Cost Averaging (DCA) or Bitcoin Dollar Cost Averaging refers to investing a fixed amount of USD/cash into BTC, in regular time intervals.

For example, buying $5 bitcoin every week.

This DCA strategy is mostly used by investors who are looking to hold Bitcoin for the long-term, as it protects them from potentially buying at price peak or high prices.

An extensive look at Bitcoin Dollar Cost Averaging can be seen here: www.dcabtc.com. Using the tool, you can visualize how much buying a given amount of BTC would have returned over a specified time frame.

DCA could also simply take this form: “When price pumps, you buy small; when price dips, you buy more.”

Traditionally, holding cash is subject to charges, fees and no sizable interest. Most savings accounts do not even return the owners exact funds after a five (5) year period; as you are charged maintenance fees for simply holding cash in your account.

Conversely, bitcoin and cryptocurrencies have proved a better asset. While being cheap and easy to use, buying small quantities of BTC or crypto has its benefits. They include:

Do you have a Bitcoin buying strategy? Share with us in the comments.

NOTE: This post does not represent investment advice. Always Do Your Own Research (DYOR).