While many non-coiners and detractors discussed Bitcoin and the world’s ecomomic crash due to the Coronavirus pandemic, investors and bitcoiners seem to see an “opportunity” in the current state of the market.

With so many people around the world now working from home, as part of social distancing and self-quarantining measures taken to prevent spread of the COVID-19 virus; online searches related to cryptocurrencies have spiked.

A look at Google search results for Bitcoin in Nigeria, show an increase to 67 after a decline to 62 on March 13 – the date of the biggest daily drop in BTC price in the last seven years.

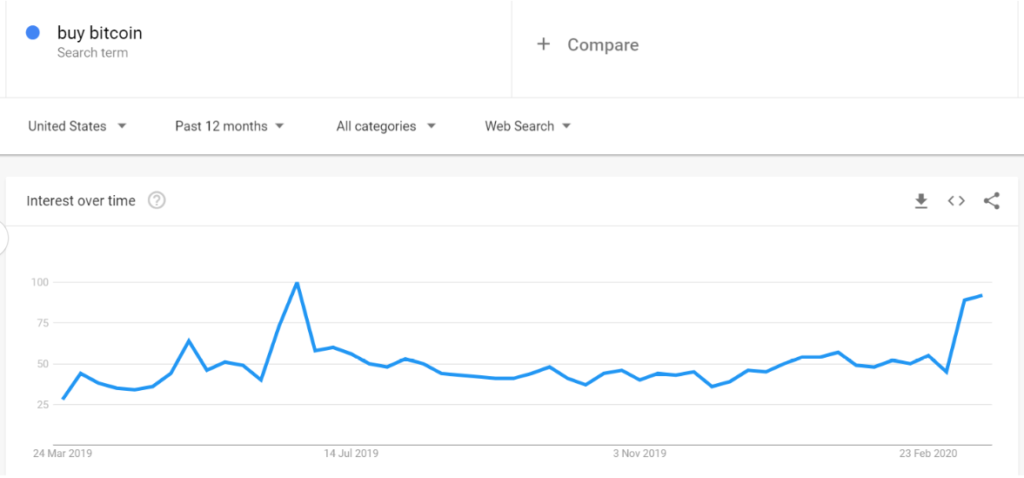

Similarly, Google Trends in the United States also indicate a 30-day high interest in the number one cryptocurrency and other coin assets.

In Corona hit China, its search engine Baidu has also seen a jump in searches for Bitcoin (BTC) by over 183% over the past 30-days; with searches for cryptocurrency information at a high on mobile device data.

The surge in the Bitcoin search numbers may be related to the narrative that a global economic recession or depression may lead to cryptocurrency becoming a hedge over cash and traditional banking systems.

Another explanation for this increasing interest in cryptocurrencies could be attributed to the upcoming Bitcoin BTC halving which is 49 days away. Anticipation seems to be brewing as the event approaches, with many expecting a rise in Bitcoin BTC price pre and post the halving event; as seen in past times.

From a psychological view point, the world population is in a pause mode with ecoonmic activities in most countries grounded; many have taken up the time to research and buy cryptocurrencies at a discount in the hopes that the asset’s utility rises above the current epidemic restrictions.

In all, the search trends seem surprising as many who predicted huge BTC sell offs have seen bitcoin investors and traders hold on to their coins; and statistics currently show that many even look to buy more Bitcoin.

Read: Three (3) Good Things About the Bitcoin Market Crash of 2020.